A stock is a piece of ownership in a company. When you buy one share of Apple stock, you literally own a tiny piece of Apple Inc.

Think of it like this: If a company is a pizza cut into a million slices, each slice is one share. Buy a slice, own part of the pizza.

That’s it. That’s what a stock is.

Stock = Ownership

Let’s make this crystal clear with a real example.

Starbucks Corporation:

- Has about 1.15 billion shares

- If you buy 100 shares, you own 0.0000087% of Starbucks

- You own a piece of every Starbucks café, every coffee bean, every espresso machine

What does ownership mean?

As a shareholder, you:

- Can make money if the stock price goes up

- Get voting rights (you can vote on company decisions)

- May receive dividends (share of company profits)

- Benefit when the company grows

- Don’t have to manage the company (that’s the CEO’s job)

- Can’t walk into a Starbucks and demand free coffee (you’re a tiny owner, not the boss)

Your ownership gives you rights, but not control (unless you own millions of shares).

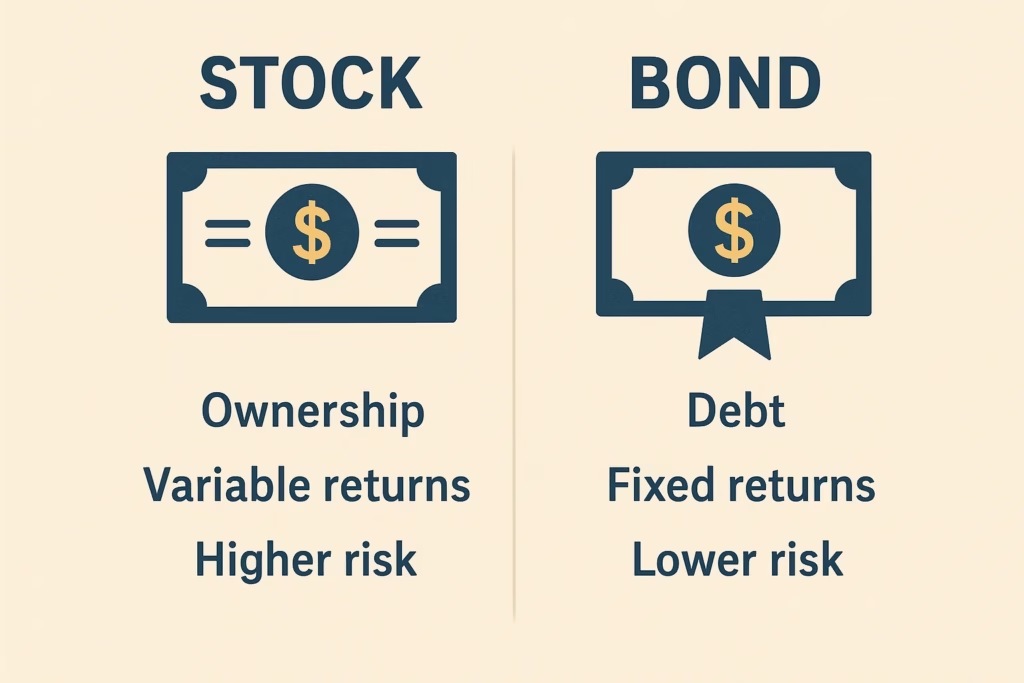

Stock vs Bond: Ownership vs Debt

This is important. Many people confuse stocks with bonds. They’re completely different.

STOCK = OWNERSHIP

When you buy a stock:

- You OWN part of the company

- You share in the company’s success or failure

- If the company does well, your stock value goes up

- If the company fails, you could lose your investment

- No guaranteed returns

Example: You buy Tesla stock for $440. Tesla becomes more successful. Stock goes to $600. You made money because the company grew.

BOND = DEBT (Loan)

When you buy a bond:

- You LEND money to the company (or government)

- The company promises to pay you back with interest

- You get fixed payments, regardless of how well the company does

- Lower risk, lower reward

- You’re a lender, not an owner

Example: You buy a $1,000 bond from Coca-Cola at 5% interest. You’ll get $50 per year for 10 years, then your $1,000 back. Doesn’t matter if Coca-Cola makes $10 billion or $50 billion in profit, you still just get your $50.

Key Difference in Simple Terms

Stock: “I own a piece of this company. If it succeeds, I succeed. If it fails, I lose.”

Bond: “I loaned money to this company. They owe me back with interest. I’m getting my money back whether they do great or just okay.”

Why Do Companies Issue Shares?

Companies sell shares for one main reason: to raise money without taking on debt.

The Three Ways Companies Get Money

Option 1: Profit/Revenue

- Use their own earnings

- Problem: Takes time to build up, limits growth speed

Option 2: Borrow (Bonds/Bank Loans)

- Get money now, pay it back later with interest

- Problem: Must repay even if business struggles, interest payments add up

Option 3: Sell Shares (Issue Stock)

- Get money now, never have to pay it back

- Problem: Give up partial ownership and control

Most growing companies choose Option 3.

Real Examples: Why Companies Issue Shares

Example 1: Airbnb (2020)

Situation:

- COVID-19 hit, travel stopped

- Company needed cash to survive and grow

- Didn’t want massive debt

Solution:

- Went public (IPO) in December 2020

- Raised $3.5 billion by selling shares

- Used money to expand, improve technology, weather the crisis

Result: Stock opened at $146, jumped to over $174 on day one. Today (October 2025), investors who believed in Airbnb’s vision have seen returns.

Example 2: Rivian (2021)

Situation:

- Electric vehicle startup

- Needed billions to build factories and produce trucks

- Banks wouldn’t loan that much to an unproven company

Solution:

- Went public in November 2021

- Raised $12 billion by selling shares

- Became one of the biggest IPOs ever

Result: Got the money to build vehicles without crushing debt payments.

Example 3: Google (2004)

Situation:

- Small search engine company

- Wanted to expand globally, hire thousands, build data centers

- Needed billions, but wanted to maintain flexibility

Solution:

- IPO raised $1.67 billion

- Sold shares at $85 each

Result: That $85 has grown into thousands per share today (after splits). Early investors made fortunes, and Google got the money to become the tech giant it is.

What Happens When a Company Issues Stock?

Let’s walk through the process:

Before Going Public (Private Company):

- Owned by founders, employees, early investors

- Example: You and two friends start a company, split it 33% each

Decision to Go Public:

- Company is growing fast, needs $100 million

- Decides to sell 25% of the company to the public

The IPO (Initial Public Offering):

- Company works with investment banks

- Decides to create 10 million new shares

- Prices them at $10 each (10 million × $10 = $100 million)

- Opens trading on stock exchange (like NASDAQ)

After Going Public:

- Founders now own 75% combined

- Public owns 25% (the 10 million shares)

- Company has $100 million to grow

- Anyone can buy shares on the stock market

Ongoing:

- Stock price changes based on supply/demand

- Company doesn’t get money from these trades (only from the IPO)

- Shareholders can buy/sell freely

Types of Stock

There are two main types:

Common Stock

- What most people buy

- Get voting rights

- May receive dividends

- Higher growth potential

- Higher risk

Example: Apple common stock (ticker: AAPL)

Preferred Stock

- Priority for dividends

- Usually no voting rights

- Acts more like a bond

- Lower risk, lower reward

- Less common for individual investors

Example: Banks often issue preferred stock

For beginners: Focus on common stock. That’s what 95% of investors buy.

What You’re Actually Buying

When you buy a stock, you’re buying:

1. A Claim on Assets

- If the company owns $10 billion in cash, buildings, and equipment

- And has 1 billion shares

- Each share represents $10 of assets

2. A Claim on Future Earnings

- If the company makes $5 billion profit per year

- And has 1 billion shares

- Each share represents $5 of annual earnings

3. Voting Rights

- Usually 1 share = 1 vote

- Vote on board members, major decisions

- (Though small shareholders have minimal influence)

4. Potential Dividends

- If the company pays dividends, you get your share

- Not all companies pay dividends (especially tech companies)

Real Example – Microsoft:

- You buy 10 shares at $415 each = $4,150 investment

- You own 0.0000001% of Microsoft (tiny, but real!)

- You get $7.28 per year in dividends (10 shares × $0.728/share)

- You can vote on company matters (your 10 votes won’t change much, but you have the right)

- If Microsoft grows 15%, your shares are now worth $4,772.50

How Stocks Are Named

Every stock has a ticker symbol – a short code to identify it.

Examples:

- Apple: AAPL

- Microsoft: MSFT

- Tesla: TSLA

- Amazon: AMZN

- Coca-Cola: KO

- Nike: NKE

- Disney: DIS

These tickers are what you use to buy stocks. You tell your broker “Buy 10 shares of AAPL” not “Buy 10 shares of Apple Inc.”

Share Price vs Company Value

Important distinction:

Share Price = What one share costs Market Cap = Total company value

Formula: Market Cap = Share Price × Total Shares

Example: Two Companies

Company A:

- Share price: $10

- Total shares: 1 billion

- Market cap: $10 billion

Company B:

- Share price: $500

- Total shares: 10 million

- Market cap: $5 billion

Company A is actually worth MORE even though its share price is lower!

Lesson: Don’t judge a stock by its price per share. A $10 stock isn’t “cheaper” than a $500 stock. Look at the total company value (market cap).

Common Beginner Mistakes

Mistake 1: “This stock is $10, that one is $300. The $10 one must be a better deal!”

Reality: Price per share means nothing. A $10 stock could be overpriced and a $300 stock could be undervalued. Look at market cap and company fundamentals.

Mistake 2: “I own stock, so I can boss the company around!”

Reality: Unless you own millions of shares, you have basically zero influence. You have voting rights, but your vote is a drop in the ocean.

Mistake 3: “Stocks and bonds are the same thing.”

Reality: Stocks = ownership. Bonds = debt. Completely different risk/reward profiles.

Mistake 4: “The company keeps all the money when I buy their stock.”

Reality: The company only gets money during the IPO. After that, you’re buying from another investor, not from the company.

Why This Matters to You

Understanding what a stock really is changes everything:

Before understanding: “Stocks are just numbers that go up and down. It’s like gambling.”

After understanding: “Stocks are ownership in real businesses. When I buy Tesla stock, I own part of Tesla. If Tesla sells more cars and makes more profit, my ownership becomes more valuable.”

This mindset shift is huge. You’re not gambling on random numbers. You’re investing in actual businesses that make products, serve customers, and generate profits.

Let’s Recap

A stock isn’t just a number on a screen. It’s a piece of a real company.

When you own stock in McDonald’s, you own part of 40,000+ restaurants worldwide. When you own Netflix stock, you own part of the streaming service in 190+ countries.

You’re not gambling. You’re becoming a business owner.

That’s the power of stocks.

- Stock = Ownership in a company, not debt

- Ownership gives you: potential for profit, voting rights, possible dividends

- Bonds = Debt, completely different from stocks

- Companies issue shares to raise money without taking loans

- Common stock is what most people buy and trade

- Share price alone doesn’t tell you if a company is expensive or cheap

- You’re buying real ownership in real businesses, not just trading numbers

What’s Next?

Now that you know what a stock is, you’re ready to learn:

- How stock prices are determined

- How to analyze if a stock is worth buying

- Different types of stocks (growth, value, dividend)

- How to actually buy stocks

Understanding that stocks represent real ownership in real companies is the foundation of everything else in investing.

Remember: This is educational content only. Stock ownership involves risk. Always do your research before investing. Past performance doesn’t guarantee future results.